A Statistical Look at the Stock Market, Part 1: Market Cap

Rather than rely on second-hand information, I decided to dig into yahoo Finance. It's possible to create a function which systematically extracts all the ticker symbols on the yahoo Finance page by going to the screener, setting a non-constraint, and creating a program which cycles through the resulting output and picks up on the location of unique tickers in the HTML from the source page. Out of a stated total number of tickers of 6930, I was able to pull 5958; far from everything, but a respectable fraction.

One can then create another program which takes a user-specified list of tickers and digs into the 'key statistics' and 'industry' tabs on yahoo Finance, pulling out the columns of interest from both for all tickers, spitting the output into a matrix. For starters I pulled market cap, industry, ttm P/E, fwd P/E, Price/Book, EV/EBITDA, Dividend Yield, Beta, and Industry.

I'm going to go back in for a second round, but here are some facts which I picked up.

Market Cap:

Size:

The aggregate market cap of my 'market' was $22.1 trillion. The stated market cap of the NYSE is $20 trillion, indicating to me that this index, while imperfect, is indeed fairly robust.

- Capitalization Breakout:

Now let's say you're a big fund manager with a huge line to throw around, and as a result you can invest in nothing but large cap stocks ($1B+ MC). What is your universe? How about mid cap investors? Small cap?

-According to this data, there are 1852 large caps, 698 mid caps, and 3344 small caps. In other words, there are nearly twice as many small caps as there are large caps. The benefit to sticking with large caps is really obvious from the data though. The large cap space has $21.1T in market cap terms. The mid cap and small cap spaces have $509B and $488B, respectively. In other words, relative to a small cap investor, the large cap investor has half as many stocks but 40 times as much potential total equity to invest in. I was actually surprised that the small cap space wasn't more disperse-- however it should be kept in mind that the total number of small caps is highly likely to be biased downwards, because many small caps don't have legitimate key statistics data and the truly small stocks (with prices less than a buck) were kicked out.

Comparison to Hedge Funds and Mutual Funds:

To put this in perspective, we can look at the emergent hedge fund and mutual fund industries.

- While $1T seems to be the most popular estimate of hedge fund assets under management, John Mauldin actually estimates it to be closer to $2T (original study done by Strategic Financial Solutions). They arrived at that estimate by analyzing 12 hedge fund databases, removing duplicates and clones, and differentiating between fund of funds and single manager funds. According to them, the ~4000 single manager funds accounted for the lions share of assets under manager at $1.5T, with a mere 175 or so past the $1B mark. In total, they estimated ~7,700 hedge funds and CTA's (commodity trading advisors).

- The mutual fund space is much, much larger, with almost 8000 US-based mutual funds and $8T under management. Worldwide, the mutual fund industry is much larger, at an estimated $15T.

The numbers speak for themselves-- it's somewhat staggering that worldwide, there is an estmated $17T in assets under management, 85% of the NYSE in market cap terms and 77% of my total market estimate, but a few points merit making:

It goes without saying, but these hedge funds and mutual funds are not only investing in equity, but also in debt, the world market value of which is larger than the equity markets. The market value of worldwide equity in dollar terms has been estimated to be $36T. That of the bond market is $49T, 36% larger. The sum total of these two is $85T, which implies that mutual fund and hedge fund assets are a less alarming 20% of total worldwide debt and equity markets.

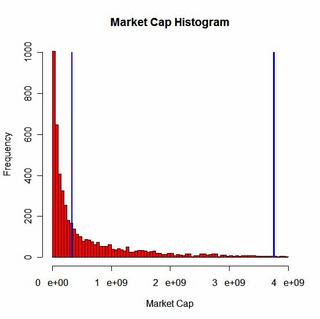

It might be of value to take a look at the actual distribution. I plot a histogram of it below:

(Sorry for the lack of clarity). The left blue line is the median market cap, at $337M (small!). The right blue line is the average total market cap of $3.75B, indicating a huge amount of skew from some of the bigger stocks in the index. As expected, Exxon Mobil is the largest stock in the market. The smallest stock goes by the name of LFG International Inc., with a market cap of a whopping $5k. I wonder why it even bothers to be a publicly traded company, considering the fact that their capital structure is apparently almost entirely financed with debt (its enterprise value is $1M).

The key take-away for me from this is that I should make sure to be more specific when I say that I'm in a crowded space or not. There may be a lot of money in hedge funds, but to then reach the conclusion from this fact that the market has suddenly become really really efficient as a result might be a stretch. I may want to pay attention to the breakout of hedge fund assets deployed in the various market classes.

The fact that small caps as an asset class are 40 times smaller than large caps is a double edged sword in my point of view. It is definitely true that a lot of people can't play there because it truly is a small asset class. That being said, its small size may prove to be a liability should hedge funds, hungry for new places to go and new asset classes to trade, decide that small caps might provide a decent return on their time. There isn't all that much to go around.

0 Comments:

Post a Comment

<< Home