A Statistical Look at the Stock Market, Part 2: Market Caps with Industry Focus

Another interesting statistic might be just how big each industry in the market is in market cap terms. Could be helpful when considering what your capacity may be, should you focus on a particular market segment.

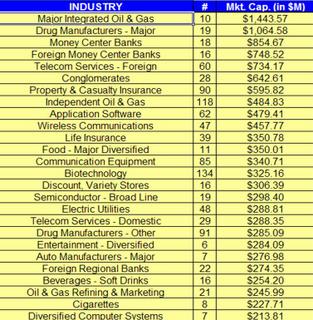

According to yahoo finance, there are approximately 221 industries. Obviously it's then impossible to really list them all out-- but what we can do is take some of the most populous industries as well as some other notable ones to try and draw some conclusions. Below are a few interesting facts (chart of the 26 biggest industries below):

- Believe it or not, it appears that there are more regional banks and S&L's than there are stocks in any other industry. There were 220 S&L's in the set, 146 banks in the northeast region, 139 banks in the mid-atlantic region, 101 banks in the pacific region and 95 banks in the mid-west region. The only other industries which are in the top 10 were 'business software and services' (#3), 'business services' (#5), biotech (#6), independent oil and gas (#7), and 'scientific and technical instruments' (#8).

- That being said, regional banks and S&L's are by no means the largest industries. The market size for S&L's in aggregate is $134.6B. Banks in the northeast were even smaller at $81.8B.

- Perhaps as expected, the largest industry in terms of market cap is Major Integrated Oil & Gas at $1.4T, or 7.2% of our economy. The funny thing is that there are only 10 stocks in the industry (of course, the 10 include XOM, BP, and RD).

- Given all the talk of real estate bubbles, why not take a look at the REIT's as an industry in terms of size and composition. From what I can see, there are 157 REIT's thrown into 7 categories-- Diversified, Healthcare, Hotel/Motel, Industrial, Office, Residential and Retail-- with a sum total market value of $302B split. This, by the way, is almost in perfect agreement with Barron's own estimate of the market size of the REIT industry of $300B. While $300B may not sound terribly bad, one must also remember that market cap understates the industry's economic size, which is probably better estimated by enterprise value. In EV terms the REIT market is $600B, twice as large.

- Looking at the numbers though, I am not so sure Barron's argument that REIT's have been so bought up that dividend yields aren't compensating enough for their riskiness-- the numbers that I have indicate the average dividend yield is 6.25%, not their quoted 4.5%. For all you yield hogs, check out RPI, CUZ, SAX and AZL. What kind of a whacked up stock has a dividend yield over 50%??

This is all a very low-level analysis, but at least to me it's underscored how important it is to question assumptions and double-check numbers. The information is there, whether it's individual stock data, industry data, economic data, or what have you. As long as you're facile enough with data manipulation to tinker around and do the proper tests (which doesn't take any rocket scientry), I think it's possible to get a much deeper understanding of the nature of the relationship between a set of processes you happen to be looking at. Overlay on top of that some solid individual stock analysis and your analysis could be all the more thorough.

The question then becomes... are there any quantitative ways one could go about identifying an industry in a state of flux, and are there any properties I would hope to see in the industries and/or individual stocks I invest in? That's the topic of another posting.

2 Comments:

Dan,

That's some nice analysis. Surprising to see that the number of REITS was only 157. Are you using Excel VBA to pull from yahoo finance? Looking forward to your next article.

Pavan

By Anonymous, at 12:38 PM

Anonymous, at 12:38 PM

Hi Pavan,

Thanks for the comment. I actually do all my analysis in R, which I talk about in one of my prior posts ('Mining the Web for Indicative Data'). Excel is nice but it sometimes has some real trouble handling large datasets.

By Dan McCarthy, at 4:13 PM

Dan McCarthy, at 4:13 PM

Post a Comment

<< Home