IXDP is now WisdomTree Investments (WSDT.PK); Deeper Look at PowerShares

It's official.

PowerShares-- Bulking Up Its Management Too?

Interestingly enough, it seems that PowerShares is in some ways following WSDT and upping that management team. They hired Benjamin Fulton as SVP of Product Development and Edward McRedmond as SVP of Portfolio Strategy.

Taking a Look at Fulton:

Surprisingly enough, Fulton spent some time at Nuveen Investments. As a side note, WSDT has had some background with Nuveen if I remember correctly; I believe one of their earlier index ideas was in some way related to something Nuveen had created. Thankfully no lawsuits were thrown (I guess WSDT was in the right!). Needless to say nothing came of those indices so nothing to worry about on that front.

The article linked above mentions his being an MD at Nuveen with a focus on product development. Will most likely be a big logistical help for PS. That being said, Nuveen is an ETF sponsor and has introduced ETF's of its own, which begs the question. Might it be a little more helpful to hire someone with some real ETF experience, especially if you are poaching an ETF sponsoring firm like Nuveen? If he had any direct ETF background, they would have said so in the articles I would imagine.

Bottom line IMHO is that this is definitely a step up for PS. Fulton is nothing to shake a stick at. But it might have been nice to have had a little more ETF-specific experience. His background in bringing products to market puts him in a position similar to Morris at WSDT. I like Morris more.

Taking a Look at Edward McRedmond:

The article linked to above speaks to McRedmond's background pretty thoroughly. He seems to have done some solid analysis of the ETF space and probably has a stronger grasp of the product than most people. Only question I have about him is why, after a full 17 years at AG Edwards, he couldn't move any higher than Associate Vice President. At Citigroup, time-adjusted, this doesn't amount to a super ton.

Getting a Better Picture of PS's ETFs:

They've got around 23 ETF's in total which they basket into four flavors.

A Closer Look at PS's Dividend ETF Portfolio:

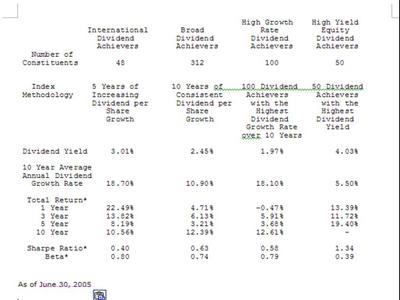

One very popular flavor is dividends, the oldest of which is PEY, the High Yield Equity Dividend Achievers ETF. They now have 4 dividend-based ETF's in total-- the other three are the International Dividend Achievers (PID), Dividend Achievers (PFM), and High Growth Rate Dividend Achievers (PHJ). Statistics on these portfolios are contained below.

Enough with the boring details-- can you guys see anything interesting about the historical performance statistics? This is not too hard to see.

... the historical performance of the newly created ETF's suck, unless I'm really missing something. The Sharpe for the flagship PEY knocks the freaking socks off of the three new ETF's. And at the same time, the historical Beta is around half that of the newbies! They are publicly announcing this themselves?

... the historical performance of the newly created ETF's suck, unless I'm really missing something. The Sharpe for the flagship PEY knocks the freaking socks off of the three new ETF's. And at the same time, the historical Beta is around half that of the newbies! They are publicly announcing this themselves?

This begs the question-- why the hell should I invest in these other funds if the performance is so much worse, even in the past??? You can trade all the options you want on these things (yes, on the AMEX you can trade options on the newbs), but returns will not magically appear. Pile onto that the fact that the newbs are probably far more illiquid, and all I can see is a pretty bad deal. But hey, maybe I'm missing something. Moving on!

Other ETF's in the Portfolio:

PS also has a large basket of industry-specific ETFs (ie. Biotech&Genome portfolio, Food&Beverage, Leisure&Entertainment, Pharmas, ...) and another basket of style-specific ETF's (ie. Value, Growth, varying cap ranges). They have two funds which track the broader market with the Intellidex Enhancement. Finally, they've got a couple of weird ones which don't really fit into any of the above classifications (a China ETF and an alternative energy ETF). The China ETF is basically filled with a bunch of ADRs. I honestly haven't done too much about it, except that it's pretty heavily weighted towards oil right now. Me being my usual cynical self, I will just throw a points out here to jab at this China ETF a little, and open up to discussion why this may be the case. Will leave the rest for another day.

Here are hypothetical historically backtested results for "Dragon Halter": Beta is 1, Sharpe is 1.02, Correlation is 0.5. All statistics are based on the past 3 years relative to the MSCI EAFE, which is supposed to be representative of foreign stocks. As expected, these hypothetical statistics handily beat the MSCI EAFE, which has a sharpe of 0.14 and a beta and correlation, by default, of 1.

They then show their hypothetical performance over the past year, and their actual performance since inception, as of June 1st 2005. No statistics given for these time periods, except that the performance was markedly worse. Over the past year they had a theoretical return of 4.92%, lagging the S&P and the EAFE. Since actual inception, they have lost money and are currently down 5.40%, while the EAFE and the S&P are up 9.87% and 1.17% respectively. Past performance is not indicative of future results; it seems for this China ETF, we may not even want the hypothetical past performance at all.

Fundamental Indexing

Last thing I thought I would bring up is Bob Arnott from RA. I wrote about him a while back myself. To recap, I was highly impressed with his study. That being said, it seemed he didn't fully flesh out statistics driving the implied investment thesis pertaining to mean reversion.

Well, apparently PS (in addition to Allianz) is jumping on the idea and creating an index around Arnott's research. The expense ratio will be 60 basis points which isn't bad. That being said, something tells me Arnott will be the winner in this one, making some serious jack on the licensing fees off of two companies. Should one get off the ground (doesn't matter to him which one, which would explain his licensing to two companies), he will probably be collecting a nice little check.

So What Is WSDT Thinking About?

Looking back, there have been a handful of strategies mentioned in studies done by Professor Siegel. One, incidentally, was a dividend study. I guess that space seems taken! The other was a study showing the historical performance of the original stocks in the Dow I believe, and how they haven't done all that badly if one were to reinvest dividends, reinvest gains from acquired companies, etc etc. I am doubtful that they would somehow base a strategy off of this.

And with Arnott essentially throwing his strategy out among ETF sponsors for them to tear at eachother, I am not too sure they can really do much with a cap-adjustment strategy.

Index volatility-dependent autocorrelation trading anybody? What do you think Chilton? ;)

That's the latest from me on the enhanced ETF space.

0 Comments:

Post a Comment

<< Home