WisdomTree Update

I haven't posted in a while but I believe all that has been happening at WisdomTree merits a post.

The bottom line

The bottom line

WisdomTree is focusing on dividend ETF's, and has filed to release 20, 6 of which are domestic and the other 14 international, based on the premise that stocks which pay dividends regularly tend to outperform the market on a risk-adjusted basis.

How this plays into things I've said in the past on this blog

I mentioned in this post that that Siegel did a dividend study, but that PowerShares and others had released more than enough different divident products. My conclusion was that it was unlikely that they would pursue dividend ETF's. Ironic then that the lion's share of their ETF's are indeed targeting dividend's-- quite a crowded space.

The driving point of this post was that they now have a nice, full bench of experienced professionals to smoothly bring them from idea to implementation. This post as well as the aformentioned one also contrasted WSDT to PowerShares in this regard. PS simply didn't have the management pedigree, even though their product offering were solid enough. Interesting to see, then, that PS was acquired by Amvescap. To me this makes some sense, although Amvescap is an interesting acquirer-- Amvescap could leverage its size to plug some of the holes that PS was unable to fill, while PS's core asset was the theoretical strength of its products. Through acquisition, Amvescap could use its marketing and distribution experience to add value to PS, adding a respectable amount of incremental value to PS at less incremental cost to Amvescap, not even mentioning any possible cash flow issues PS may or may not have been subject to which could have cheapened their bid.

WSDT's rationale makes sense

1) One can manipulate earnings, but one cannot manipulate cash.

2) Cash dividends represent a real, direct and immediate return to shareholders. All else equal, if free cash flow is retained, one must make an underlying assumption on the company's ability to reinvest at a reasonable risk-adjusted rate. Companies that simply pay out that cash flow require no such incremental assumption.

3) Investors on the whole seem to care less about dividend yields than they perhaps should. When was the last time the dividend yield of a stock was a key component of your investment thesis on that stock?

4) Dividends by their very nature lack volatility. They produce returns uniformly over time in a very steady fashion. Contrast this to a portfolio whose return is generated entirely off capital gains and one can see why this may outperform most notably on a risk-adjusted basis.

Some thoughts

1) As a startup, it makes some sense that WSDT is focusing itself on one particular investment methodology. From a marketing point of view, this probably makes for a more unified, clear PR message-- dividend stocks tend to outperform. From a corporate identity point of view, it also makes WSDT more identifiable as a company-- "Ah yeah, WisdomTree, the dividend ETF firm." They may broaden themselves in the future, but proven performance in the dividend space probably won't confine them to the niche they are trying to carve for themselves as "that dividend ETF firm".

2) The pedigree of WSDT's management team is both a blessing and a curse from a buyout point of view. Maybe someone would consider buying this company out, but with a team consisting of superstars like Siegel and Steihardt and ETF veterans like Morris, I would think their payoff profile would be better as a standalone entity, leveraging their identity in their marketing pitch. In the event of a buyout, not only would not only be diluting their equity stake, they would also be diluting their ability to leverage their high profile identities. How would Siegel and Steinhard stand out if they were representing a handful of a sea of ETF's for a company like Barclay's? There is no wow value to that. There is wow value to saying superstars have started a firm focused on an underappreciated low-cost investment methodology, and have brought on board high profile veterans of the ETF space to make it happen. Finally, Steinhardt has a 60+% stake in this company. To acquire this company would require his approval. Would Steinhardt sell out at a time like this, before any blood has been shed? Granted, the return he's generated on this company has been enormous. I just get the impression that he decided to get involved with WSDT because of its longer term prospects, so it would seem unlikely that he would sell out in the 3rd inning.

3) Why release 20 ETFs targeting dividends? Are each and every one of these dividend ETF's special, adding value to different investor groups with varying risk preferences? In steady state, the shotgun approach is good at reaching investors across the spectrum, but until they reach steady state, they may be sacrificing the liquidity and perceived appeal of their flagship ETF. I assume they have one or two flagships which they are expecting to be the most likely to perform exceedingly well, because that has historically been the case for other companies. The others in that case may end up being a distraction.

4) What of industry concentration? Certain industries tend to yield more than others. I wish I could read the papers they have put out as I believe at least one draft is public information, but I would assume that their pursuit of high dividend stocks has concentrated their portfolios on particular sectors. I would imagine that this has big implications on the nature of the risk their portfolios take on relative to alternative portfolios which are more broadly exposed with respect to industry. When they release information on their portfolio methodology one may want to take heed of how much industry risk they are exposed to. Their portfolios may be more sensitive to external factors which impact certain industries as a whole, and may be more difficult to diversify off. This may also make risk assessment more difficult, as broad industry trends are "low resolution" by nature.

5) Where do they propose the alpha comes from? If the market were to become arbitrage free tomorrow, this portfolio shouldn't outperform other portfolios which are equally diversified with comparable cost efficiency. Stocks with very high dividends deserve those high dividends because they don't feel their personal growth prospects merit reinvestment in the business, and stocks with low dividends deserve low dividends because they can bring about greater long term shareholder value through reinvestment. In this paradigm, it may be of value to ask the question "where is this outperformance coming from?" This question by itself could be the subject of a very lengthy

research project which I am sure has at least been thought of by our friends at WSDT, in addition to the host of research papers that I haven't read. I would offer the following 'outperformance buckets', categories from which this outperformance may be flowing.

a) Investors tend to underappreciate dividends as a form of shareholder return relative to capital gains.

b) Companies that pay out higher dividends on average tend to be managed by executives who tend to grow shareholder value more than is recognized by the market as a whole.

c) Stocks that pay dividends that are too high (ie. companies that cannot in the long run support their high dividend) tend to be demanded more than is rational by "yield hogs," generating more in the form of capital gains than is justified.

d) Investors underappreciate the volatility benefits of a regular dividend payment relative to the allure of capital appreciation.

From their Filings

WSDT released a form N-1A, but not under WSDT's filings-- they filed under "WisdomTree Trust"-- on March 13th 2006. They didn't give out any information regarding what their expense ratios will be, which is a bummer. I also didn't see any information regarding the rebalancing methodology, which will to a large extent determine how much turnover to expect, which will obviously drive their expense ratio.

Managers

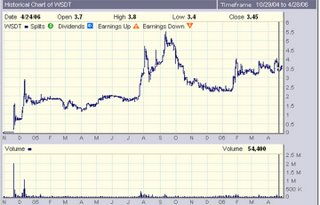

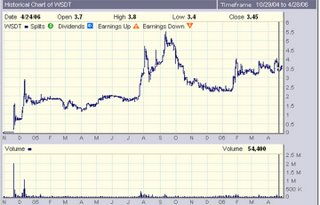

WSDT the stock-- worth it?

It is impressive how much progress they've made over a relatively short period of time. A market cap of $284mm implies $14mm in earnings at a 20 multiple. $14mm in earnings at an expense ratio of 70 bps under a seemingly reasonable cost structure implies perhaps $5B in assets under management, given that this business isn't labor or asset intensive, and seemingly its only real variable costs are transaction costs and the call option-type compensation structure which I am sure exists for the current executive team. PowerShares had $3.5B according to the latest data I was able to find, and they were out for 3 years plus. The market is currently around $400B, which implies WSDT would need to grab a small but respectable portion of the market. I would expect the industry over this time to grow, feeding off weakness in the mutual fund space, which I assume to be around $6-7 trillion right now. If even 5% of current mutual fund dollars were to be put into ETF funds through the addition of a retirement platform or an equivalent, that would nearly double the ETF market size. There is a lot of room for the ETF space to grow.

Also, the jury is still out on the ability of small startup ETF's ability to survive in the face of a market where the two largest managers account for 69% of the ETF market. PowerShares effectively removed itself from the market by getting acquired. I would assume the star power of the current management team and the BOD have a valid shot at replacing the marketing and distribution muscle it cannot hope to match its larger competitors on, but this nevertheless remains to be seen.

Given the risk of the binary nature of this stock's eventual outcome given the fact I doubt they will get bought out (perhaps a bad assumption), I would consider this if it could be a triple in three years. To be a winner it would have to do something like $15B in aggregate as a company in three years. Can a fund which isn't attempting to track the S&P or some other broader index attract this kind of flow in that period of time? It is possible, but I am not sure how probable that is.

The bottom line

The bottom lineWisdomTree is focusing on dividend ETF's, and has filed to release 20, 6 of which are domestic and the other 14 international, based on the premise that stocks which pay dividends regularly tend to outperform the market on a risk-adjusted basis.

How this plays into things I've said in the past on this blog

I mentioned in this post that that Siegel did a dividend study, but that PowerShares and others had released more than enough different divident products. My conclusion was that it was unlikely that they would pursue dividend ETF's. Ironic then that the lion's share of their ETF's are indeed targeting dividend's-- quite a crowded space.

The driving point of this post was that they now have a nice, full bench of experienced professionals to smoothly bring them from idea to implementation. This post as well as the aformentioned one also contrasted WSDT to PowerShares in this regard. PS simply didn't have the management pedigree, even though their product offering were solid enough. Interesting to see, then, that PS was acquired by Amvescap. To me this makes some sense, although Amvescap is an interesting acquirer-- Amvescap could leverage its size to plug some of the holes that PS was unable to fill, while PS's core asset was the theoretical strength of its products. Through acquisition, Amvescap could use its marketing and distribution experience to add value to PS, adding a respectable amount of incremental value to PS at less incremental cost to Amvescap, not even mentioning any possible cash flow issues PS may or may not have been subject to which could have cheapened their bid.

WSDT's rationale makes sense

1) One can manipulate earnings, but one cannot manipulate cash.

2) Cash dividends represent a real, direct and immediate return to shareholders. All else equal, if free cash flow is retained, one must make an underlying assumption on the company's ability to reinvest at a reasonable risk-adjusted rate. Companies that simply pay out that cash flow require no such incremental assumption.

3) Investors on the whole seem to care less about dividend yields than they perhaps should. When was the last time the dividend yield of a stock was a key component of your investment thesis on that stock?

4) Dividends by their very nature lack volatility. They produce returns uniformly over time in a very steady fashion. Contrast this to a portfolio whose return is generated entirely off capital gains and one can see why this may outperform most notably on a risk-adjusted basis.

Some thoughts

1) As a startup, it makes some sense that WSDT is focusing itself on one particular investment methodology. From a marketing point of view, this probably makes for a more unified, clear PR message-- dividend stocks tend to outperform. From a corporate identity point of view, it also makes WSDT more identifiable as a company-- "Ah yeah, WisdomTree, the dividend ETF firm." They may broaden themselves in the future, but proven performance in the dividend space probably won't confine them to the niche they are trying to carve for themselves as "that dividend ETF firm".

2) The pedigree of WSDT's management team is both a blessing and a curse from a buyout point of view. Maybe someone would consider buying this company out, but with a team consisting of superstars like Siegel and Steihardt and ETF veterans like Morris, I would think their payoff profile would be better as a standalone entity, leveraging their identity in their marketing pitch. In the event of a buyout, not only would not only be diluting their equity stake, they would also be diluting their ability to leverage their high profile identities. How would Siegel and Steinhard stand out if they were representing a handful of a sea of ETF's for a company like Barclay's? There is no wow value to that. There is wow value to saying superstars have started a firm focused on an underappreciated low-cost investment methodology, and have brought on board high profile veterans of the ETF space to make it happen. Finally, Steinhardt has a 60+% stake in this company. To acquire this company would require his approval. Would Steinhardt sell out at a time like this, before any blood has been shed? Granted, the return he's generated on this company has been enormous. I just get the impression that he decided to get involved with WSDT because of its longer term prospects, so it would seem unlikely that he would sell out in the 3rd inning.

3) Why release 20 ETFs targeting dividends? Are each and every one of these dividend ETF's special, adding value to different investor groups with varying risk preferences? In steady state, the shotgun approach is good at reaching investors across the spectrum, but until they reach steady state, they may be sacrificing the liquidity and perceived appeal of their flagship ETF. I assume they have one or two flagships which they are expecting to be the most likely to perform exceedingly well, because that has historically been the case for other companies. The others in that case may end up being a distraction.

4) What of industry concentration? Certain industries tend to yield more than others. I wish I could read the papers they have put out as I believe at least one draft is public information, but I would assume that their pursuit of high dividend stocks has concentrated their portfolios on particular sectors. I would imagine that this has big implications on the nature of the risk their portfolios take on relative to alternative portfolios which are more broadly exposed with respect to industry. When they release information on their portfolio methodology one may want to take heed of how much industry risk they are exposed to. Their portfolios may be more sensitive to external factors which impact certain industries as a whole, and may be more difficult to diversify off. This may also make risk assessment more difficult, as broad industry trends are "low resolution" by nature.

5) Where do they propose the alpha comes from? If the market were to become arbitrage free tomorrow, this portfolio shouldn't outperform other portfolios which are equally diversified with comparable cost efficiency. Stocks with very high dividends deserve those high dividends because they don't feel their personal growth prospects merit reinvestment in the business, and stocks with low dividends deserve low dividends because they can bring about greater long term shareholder value through reinvestment. In this paradigm, it may be of value to ask the question "where is this outperformance coming from?" This question by itself could be the subject of a very lengthy

research project which I am sure has at least been thought of by our friends at WSDT, in addition to the host of research papers that I haven't read. I would offer the following 'outperformance buckets', categories from which this outperformance may be flowing.

a) Investors tend to underappreciate dividends as a form of shareholder return relative to capital gains.

b) Companies that pay out higher dividends on average tend to be managed by executives who tend to grow shareholder value more than is recognized by the market as a whole.

c) Stocks that pay dividends that are too high (ie. companies that cannot in the long run support their high dividend) tend to be demanded more than is rational by "yield hogs," generating more in the form of capital gains than is justified.

d) Investors underappreciate the volatility benefits of a regular dividend payment relative to the allure of capital appreciation.

From their Filings

WSDT released a form N-1A, but not under WSDT's filings-- they filed under "WisdomTree Trust"-- on March 13th 2006. They didn't give out any information regarding what their expense ratios will be, which is a bummer. I also didn't see any information regarding the rebalancing methodology, which will to a large extent determine how much turnover to expect, which will obviously drive their expense ratio.

Managers

- Kurt Zyla and Todd Rose are managing the domestic funds.

- Lloyd Buchanan and Robert Windsor are managing the international funds.

WSDT the stock-- worth it?

It is impressive how much progress they've made over a relatively short period of time. A market cap of $284mm implies $14mm in earnings at a 20 multiple. $14mm in earnings at an expense ratio of 70 bps under a seemingly reasonable cost structure implies perhaps $5B in assets under management, given that this business isn't labor or asset intensive, and seemingly its only real variable costs are transaction costs and the call option-type compensation structure which I am sure exists for the current executive team. PowerShares had $3.5B according to the latest data I was able to find, and they were out for 3 years plus. The market is currently around $400B, which implies WSDT would need to grab a small but respectable portion of the market. I would expect the industry over this time to grow, feeding off weakness in the mutual fund space, which I assume to be around $6-7 trillion right now. If even 5% of current mutual fund dollars were to be put into ETF funds through the addition of a retirement platform or an equivalent, that would nearly double the ETF market size. There is a lot of room for the ETF space to grow.

Also, the jury is still out on the ability of small startup ETF's ability to survive in the face of a market where the two largest managers account for 69% of the ETF market. PowerShares effectively removed itself from the market by getting acquired. I would assume the star power of the current management team and the BOD have a valid shot at replacing the marketing and distribution muscle it cannot hope to match its larger competitors on, but this nevertheless remains to be seen.

Given the risk of the binary nature of this stock's eventual outcome given the fact I doubt they will get bought out (perhaps a bad assumption), I would consider this if it could be a triple in three years. To be a winner it would have to do something like $15B in aggregate as a company in three years. Can a fund which isn't attempting to track the S&P or some other broader index attract this kind of flow in that period of time? It is possible, but I am not sure how probable that is.